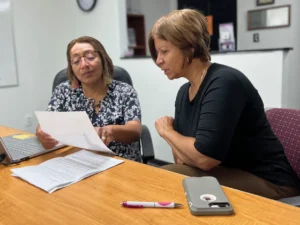

Teri Williams, CEO of the Black-owned OneUnited Bank, is well aware of the challenges that many prospective Black homeowners face, including low credit scores.

By partnering with the credit reporting app Esusu, OneUnited hopes to see its users build their credit based on their positive rental histories. The app reports consumers’ monthly rental payments to credit bureaus to help them build credit.

“Historically, it has not been included,” Williams told the Miami Herald. “They ding you when you pay your credit card 30 days late, but you may still be paying your rent every month on time.” Esusu — an African word for an informal, community-driven financial system — was founded in 2018 by entrepreneur Wemimo Abbey, who was inspired by his experience of emigrating to America.

Read more at: https://www.miamiherald.com/news/local/community/miami-dade/article304458941.html#storylink=cpy